Zimbabwe is once again sinking into economic chaos. The country’s newest currency, the Zimbabwe Gold (ZiG), which was introduced in April with promises of stability and strength, has already lost more than 49% of its value. Government officials are telling people not to worry, claiming that the economy is doing well, but ordinary Zimbabweans are living a very different reality.

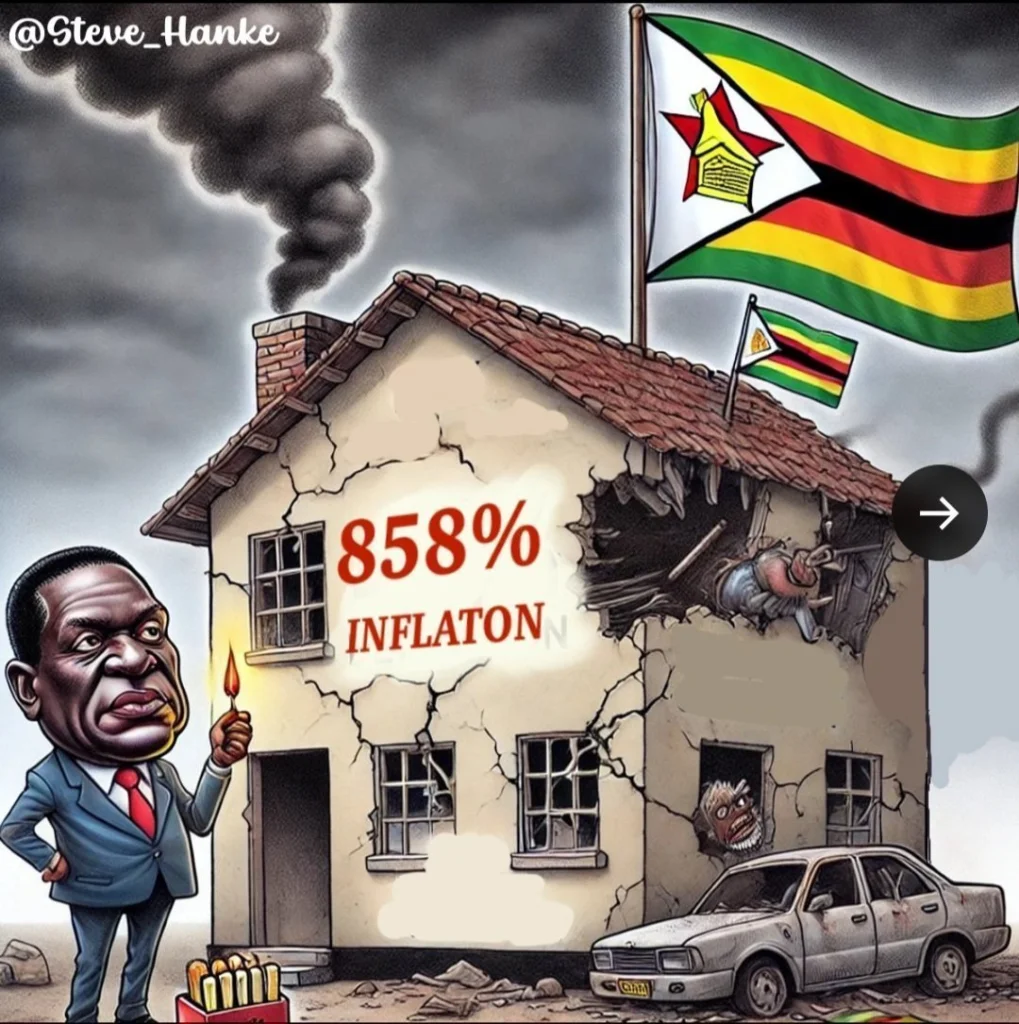

Inflation is rising fast. The government says inflation in August was just 3.7%, but independent economists say it’s closer to 858%. This massive difference shows a clear problem—either the government is hiding the truth, or it is completely out of touch with what is happening on the ground. And for ordinary citizens, the truth is clear: prices are going up every day, and life is becoming harder.

Look at the price of Mazowe, a popular fruit drink found in many homes. In February, it cost US$3. By mid-year, it was US$5.10. Now, it costs US$7.20. That’s more than double in just a few months. Salaries are not going up, but prices keep rising. This is the daily struggle that people in Zimbabwe are facing. They do not need economists or politicians to tell them what’s going on—they see it every time they go to the shops.

The black market exchange rate also tells a painful story. While the official rate is US$1 to ZiG 13.8, the real street rate is US$1 to ZiG 30. This huge gap shows that people no longer trust the ZiG. They prefer to hold US dollars, and this lack of confidence is making the currency even weaker.

The ZiG was supposed to fix the problems caused by the old Zimbabwean dollar, which was scrapped earlier this year. But it has done the opposite. It has caused more confusion, more volatility, and more suffering. Since 1980, Zimbabwe has had at least six different currencies. Each one has failed. The ZiG is quickly heading down the same road.

Still, government officials continue to insist that everything is fine. Reserve Bank Governor John Mushayavanhu says inflation is under control and that the economy is stable. He points to figures showing foreign currency reserves are growing and says that the banking system is safe. But these statements mean nothing to people who cannot afford basic goods, who are paid in a currency that loses value by the week, and who watch prices double while their salaries stay the same.

The government predicts the economy will grow by 2% in 2024. But how can there be growth when people cannot afford to buy food? When businesses are struggling to plan because of exchange rate instability? When even civil servants are demanding to be paid in US dollars because they don’t trust their own country’s currency?

The truth is that Zimbabwe is not stable. It is not growing. It is not moving forward. It is stuck in another painful economic crisis, and the government refuses to face reality. The ZiG currency was supposed to bring hope, but it has only brought more fear, more poverty, and more confusion.

People in Zimbabwe have seen this before. They lived through hyperinflation in the 2000s. They saw their life savings wiped out. They were promised that things would never get that bad again. But here we are, in 2024, and the same story is playing out once more.

The government says everything is under control. But on the streets, it feels like everything is falling apart. The gap between official statements and the daily reality of life in Zimbabwe is growing wider every day. The ZiG currency is failing. Inflation is soaring. Prices are out of control. And the people are suffering.

Zimbabwe needs more than speeches. It needs action. It needs honesty. And above all, it needs a real solution. Because if things continue like this, there will be nothing left for the ZiG to collapse into. Only time will tell how long Zimbabweans can keep going under this growing economic pressure. But one thing is certain—they cannot take much more.